Cashless Cancer Treatment Through Insurance

Why Choose Apollo Hospitals for Cashless Cancer Treatment?

Expertise in Oncology

Apollo’s team of expert oncologists and surgeons offers personalized care for all cancer types, ensuring the best possible outcomes for patients.

Advanced Technology

Equipped with state-of-the-art technologies like robotic surgery, precision radiotherapy, and advanced chemotherapy, Apollo ensures accurate and efficient cancer treatments.

Comprehensive Care

From initial diagnosis to rehabilitation, Apollo provides holistic cancer care, addressing both medical and emotional needs at every stage of the treatment journey.

Cashless Hospitalization

With partnerships with 40 insurance providers, Apollo simplifies the cashless hospitalization process, minimizing financial stress for patients and their families.

Patient-Centric Approach

Apollo prioritizes compassionate care, personalized attention, and transparent communication to ensure a smooth and supportive experience for every patient.

Leadership in Oncology

As a pioneer in cancer care, Apollo integrates innovative therapies and advanced research to enhance patient outcomes and uphold the highest standards of treatment.

Insurance Partners & TPAs Of Apollo Hospitals' (As of 11-12-2024)

- Bajaj Allianz General Insurance Co. Ltd

- Care Health Insurance Limited

- Family Health Plan Ltd

- Genins India TPA Ltd

- HDFC ERGO General Insurance Co Ltd

- HEALTHINDIA INSURANCE TPA SERVICES PVT LTD

- ICICI Lombard Health Care

- IFFCO - TOKIO General Insurance Co.Ltd

- MDIndia Healthcare Services (TPA) Pvt. Ltd

- Medi Assist Insurance

- MedSave Healthcare (Tpa) Ltd

- Star Health and Allied Insurance Co. Ltd

- Paramount Health Services TPA Pvt. Ltd

- Raksha TPA Pvt.Ltd

- Reliance General Insurance

- Vidal Health TPA Pvt Ltd

- HI TPA

- CHOLA M S

- TATA AIG

- VIPUL MEDCORP TPA

- GO DIGIT INSURANCE

- Star Health and Allied Insurance Co. Ltd

- NIVA BUPA

- VOLO HEALTH TPA

- HEALTH INDIA TPA

- EASTWEST VANI

- HERITAGE HEALTH TPA

- PARK TPA

- Ericson TPA

- SAFEWAY TPA

- NAVI GENERAL INSURANCE

- LIBERTY GENERAL INSURANCE

- ICICI PRUDENTIAL

- ADITYA BIRLA

- PARK TPA

- ACKO GENERAL INSURANCE

- ROYAL SUNDERAM

- FUTUR GENERALI

- GOOD HEALTH TPA

- SBI GENERAL INSURANCE

Mediclaim Processes You Should Know

- Cashless Process

- Reimbursement Process

- Hybrid Process

- Planned Hospitalization

- Emergency Hospitalization

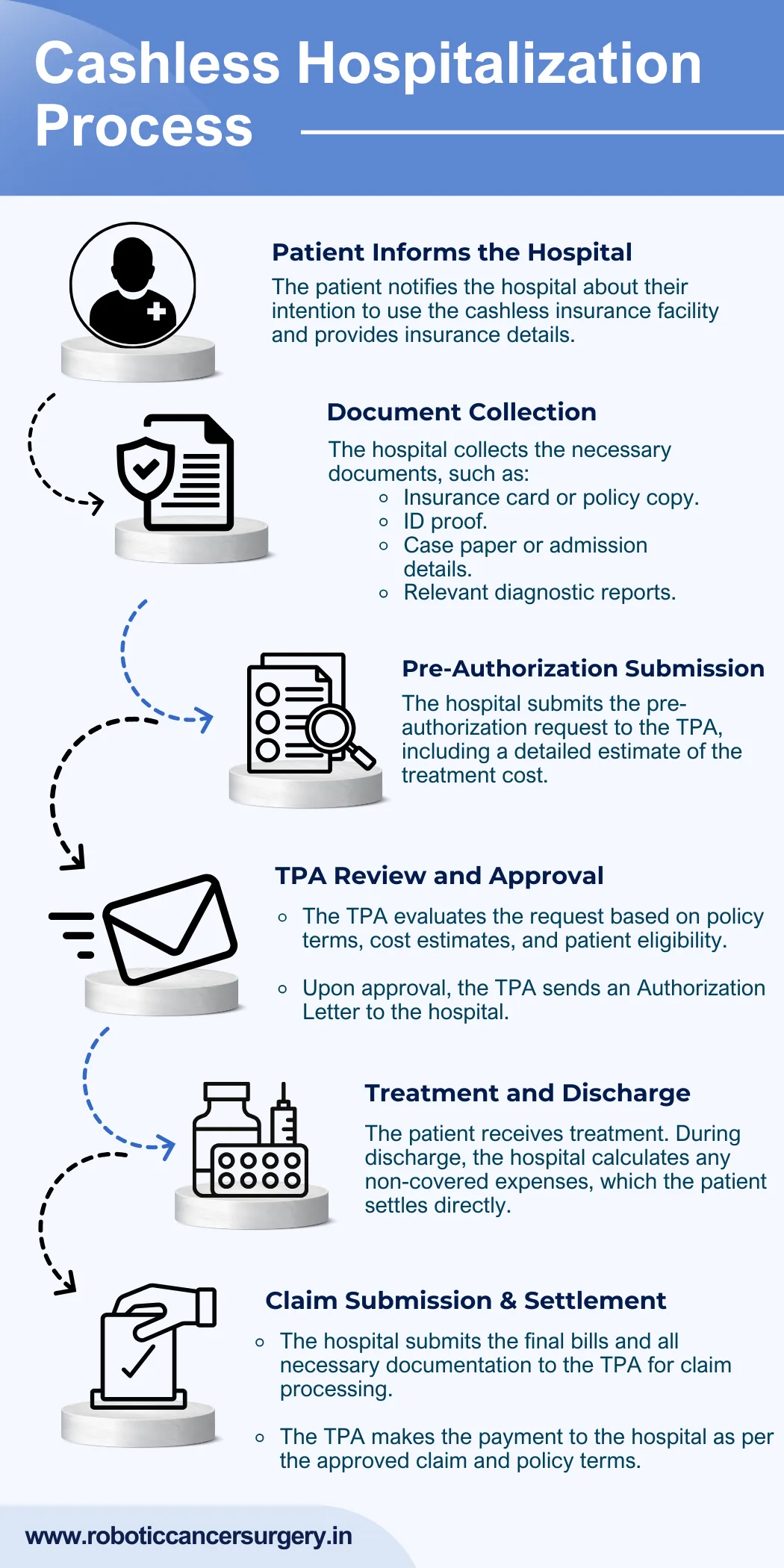

How Cashless Hospitalization Works at Apollo Hospitals?

How to Prepare for Planned Hospitalization with Insurance?

- Verify Your Insurance Policy Coverage

⦿ Understand Coverage: Carefully review your policy to confirm that your planned treatment is covered. Check for exclusions, co-payment terms, and coverage limits.

⦿ Check Network Hospitals: Ensure that your chosen hospital, such as Apollo Hospitals, is listed in the insurer’s approved network for cashless benefits.

⦿ Confirm Eligibility: Make sure your policy is active and meets all prerequisites, such as waiting periods or specific conditions for coverage.

- Prepare Essential Documents

⦿ Insurance Card: A valid card provided by your insurance company for verification.

⦿ ID Proof: Government-issued identification such as Aadhaar card, passport, or driver’s license.

⦿ Policy Details: A copy of your insurance policy or policy number for reference.

⦿ Medical Documents:

– A doctor’s prescription specifying the need for hospitalization.

– Relevant diagnostic reports and case papers supporting the treatment plan.

– Detailed medical history, if required by the insurer or TPA.

- Obtain Pre-Authorization for Treatment

⦿ Submit a Pre-Authorization Form: Fill out the insurer’s or TPA’s form with details of the treatment and estimated costs. The hospital’s insurance desk will assist you in completing and submitting it.

⦿ Provide Supporting Documents: Attach necessary medical reports and the doctor’s recommendation to facilitate quick approval.

⦿ Follow Up: Regularly monitor the status of your pre-authorization request to avoid unnecessary delays in treatment.

- Plan for Non-Covered Expenses

Not all expenses are covered under cashless insurance, so it’s important to prepare for uncovered costs.

⦿ Non-Medical Items: Be ready to pay for consumables, registration fees, or room upgrades, as these may not be included in your policy.

⦿ Co-Payment or Deductibles: Review your policy to understand any co-payment obligations or deductibles that may apply to your claim.

- Stay Informed About Claim Limits and Approval Timelines

⦿ Understand Claim Limits: Confirm that your treatment costs are within the insured amount and check for any specific sub-limits.

⦿ Approval Timelines: Pre-authorization typically takes 24-48 hours. Start the process early to ensure timely treatment approvals.

- Confirm Hospital Coordination

Effective communication between the hospital and your insurer is essential for smooth claim processing.

⦿ Insurance Desk Support: The hospital’s insurance desk coordinates with your insurer or TPA to ensure accurate submission of required documents.

⦿ Emergency Contacts: Keep your insurer’s helpline and the hospital’s insurance desk contact information handy for immediate assistance.

Role of Third Party Administrators (TPAs) in Cashless Insurance

Streamlining Insurance Claims

⦿ TPAs manage the entire insurance claim process, ensuring efficient verification of patient eligibility and smooth claim approvals.

⦿ By working on behalf of insurers, they validate treatment coverage based on policy terms, simplifying the procedure for both patients and hospitals.

Pre-Authorization for Cashless Treatment

⦿ TPAs handle pre-authorization requests for planned and emergency treatments, submitted by hospitals.

⦿ They carefully review medical reports, supporting documents, and cost estimates to confirm coverage eligibility under the insurance policy.

Streamlining Insurance Claims

⦿ TPAs manage the entire insurance claim process, ensuring efficient verification of patient eligibility and smooth claim approvals.

⦿ By working on behalf of insurers, they validate treatment coverage based on policy terms, simplifying the procedure for both patients and hospitals.

Pre-Authorization for Cashless Treatment

⦿ TPAs handle pre-authorization requests for planned and emergency treatments, submitted by hospitals.

⦿ They carefully review medical reports, supporting documents, and cost estimates to confirm coverage eligibility under the insurance policy.

Coordination with Hospitals

⦿ TPAs collaborate with a network of approved hospitals to enable smooth cashless hospitalization services for patients.

⦿ They act as a communication bridge between hospitals and insurers, facilitating timely approvals and reducing delays in the process.

Verifying Policy Coverage and Eligibility

⦿ TPAs thoroughly verify policyholder details, such as coverage limits, waiting periods, and exclusions, to ensure compliance with policy terms.

⦿ They ensure transparency by providing regular updates on claim status, eligibility, and coverage specifics to all involved parties.

Coordination with Hospitals

⦿ TPAs collaborate with a network of approved hospitals to enable smooth cashless hospitalization services for patients.

⦿ They act as a communication bridge between hospitals and insurers, facilitating timely approvals and reducing delays in the process.

Verifying Policy Coverage and Eligibility

⦿ TPAs thoroughly verify policyholder details, such as coverage limits, waiting periods, and exclusions, to ensure compliance with policy terms.

⦿ They ensure transparency by providing regular updates on claim status, eligibility, and coverage specifics to all involved parties.

Processing Final Claims

⦿ After the treatment is completed, TPAs process the hospital’s final bill and required documents to finalize claim settlements.

⦿ Approved claims are directly settled with the hospital, while patients are informed about any non-covered expenses.

Resolving Patient Queries

⦿ TPAs offer dedicated helplines to address patient queries related to claims, document requirements, or policy clarifications.

⦿ They provide clear guidance throughout the claim process, ensuring patients understand the steps and requirements involved.

Processing Final Claims

⦿ After the treatment is completed, TPAs process the hospital’s final bill and required documents to finalize claim settlements.

⦿ Approved claims are directly settled with the hospital, while patients are informed about any non-covered expenses.

Resolving Patient Queries

⦿ TPAs offer dedicated helplines to address patient queries related to claims, document requirements, or policy clarifications.

⦿ They provide clear guidance throughout the claim process, ensuring patients understand the steps and requirements involved.

Need More Information About Cashless Hospitalization for Cancer Treatment?

Frequently Asked Questions

Pre-existing cancer condition coverage depends on your insurance policy. Apollo collaborates with insurers offering specialized plans for such cases.

If approval is delayed, you may pay upfront and claim reimbursement later. Apollo ensures quick submission of all required documents to expedite the process.

Yes, cashless insurance can be utilized for emergencies. Submit the required documents within 24 hours of admission to initiate the claim process.

You can confirm your insurance validity with your TPA or insurer before admission. Apollo’s billing team also assists in verifying policy eligibility for cashless claims.